Samsung goes past Intel, and is world’s largest semiconductor supplier in 2Q21

Pushed by the strong showing of its memory semiconductors (DRAM), Samsung Electronics has gone past its archrival Intel to take the No.1 spot in chip sales in the second quarter of the year.

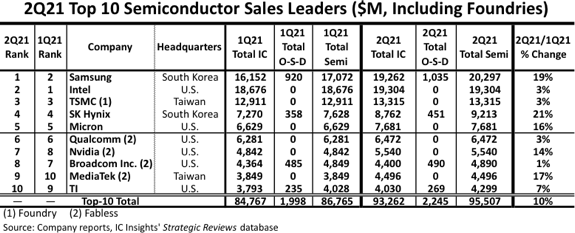

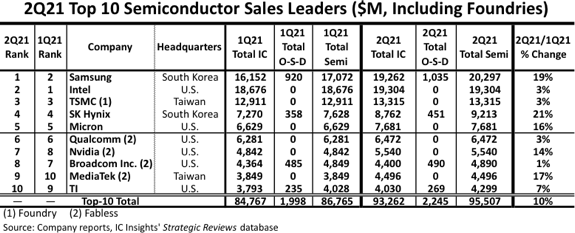

The Korean tech major logged in $20.29 billion in chip sales in the April-June period, which is a 19% rise from a quarter earlier, according to the latest McClean Report released by market researcher IC Insights.

The break-up of Samsung's sales is: $19.26 billion in integrated circuit (IC), and $1.03 billion in optoelectronic, sensor and discrete (OSD) sales.

Samsung has edged out Intel for the first time since the third quarter of 2018.

The report said semiconductor sales from the top 10 firms rose 10% quarter-on-quarter to $95.5 billion in the second quarter, beating the total industry average growth of 8%.

- Global chip shortage could stretch into 2023, Intel CEO warns

- These are the best RAM currently available

- Check our collection of the best SSDs

Top six players headquartered in the US

The IC Insights report said Samsung is likely to defend its top slot in the third quarter too with sales of $22.3 billion, beating Intel by $3.5 billion. This prediction is based on the continuing demand that memory chips enjoy.

Intel posted $19.3 billion in chip sales in the second quarter, up only 3% from the first quarter.

The IC Insights list includes six suppliers headquartered in the US, two in South Korea, and two in Taiwan and consists of four fabless companies (Qualcomm, Nvidia, Broadcom, and MediaTek) and one pure-play foundry (TSMC).

TSMC (Taiwan Semiconductor Manufacturing Company), which is top foundry firm, remained the third largest semiconductor supplier with sales of $13.31 billion, up 3% from a quarter earlier.

South Korea’s SK Hynix was at fourth after its sales grew 21% quarter-on-quarter, the highest among the top 10 vendors, to $9.21 billion followed by US memory giant Micron Technology Inc., whose sales grew 16% to $7.68 billion.

Also moving up in the 2Q ranking were Nvidia and MediaTek. Nvidia’s 14% increase came on the strength of continued growth of the company’s important data center and gaming segments. Meanwhile, MediaTek’s sales increased 17%, continuing an impressive sales upturn driven by strong demand for 5G smartphones and consumer multimedia systems.

from TechRadar - All the latest technology news https://ift.tt/3z55Fu1

Post a Comment